The 'I'll Do It This Weekend' Lie: How to Reclaim Your Sundays from Spreadsheets

You know the drill.

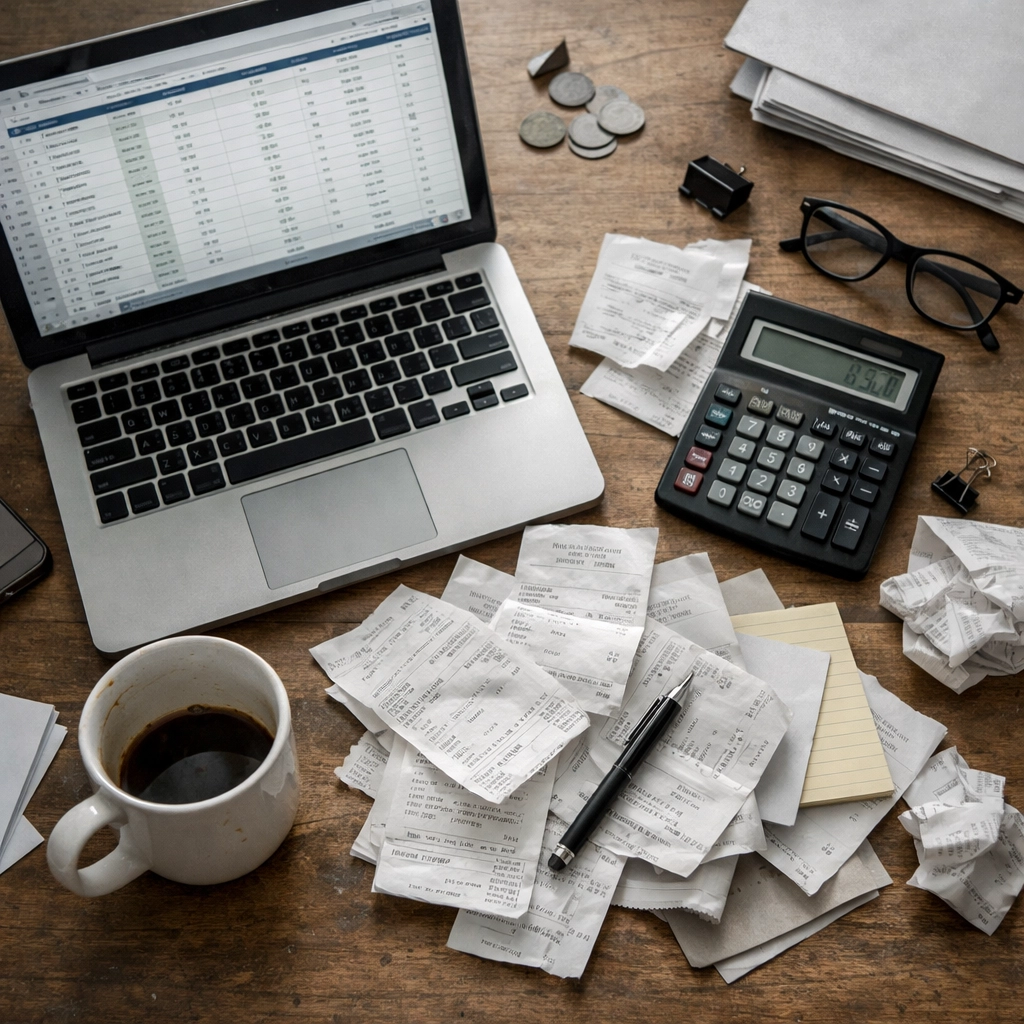

It’s Friday afternoon, you’re wrapping up the week, and that stack of receipts is staring at you from the corner of your desk. Your QuickBooks hasn’t been updated since… let’s not talk about it. And you tell yourself, again, “I’ll knock this out this weekend.”

Spoiler alert: You won’t.

I know this because I’ve heard it from nearly every client who’s walked through our doors. And honestly? I get it. You genuinely mean it when you say it. You have good intentions. But then Saturday rolls around, and suddenly your kid has a soccer game, or you realize the gutters desperately need cleaning, or, let’s be real, you just want one weekend where you’re not drowning in spreadsheets.

The Weekend Bookkeeping Fantasy vs. Reality

Here’s what you picture when you say “I’ll do it this weekend”:

- A quiet Sunday morning with fresh coffee

- You at the kitchen table, laptop open, receipts neatly organized

- Two focused hours, and boom, everything’s updated and reconciled

- The rest of your weekend free and clear

Here’s what actually happens:

- You start at 2 PM because the morning got away from you

- You can’t find half the receipts you need

- QuickBooks crashes (or you can’t remember your password)

- Three hours later, you’re frustrated, the books still aren’t done, and your family is wondering when you’re going to stop working

- You promise yourself you’ll “finish it next weekend”

Sound familiar? You’re not alone, and more importantly, you’re not failing. The system is just broken.

The Real Cost of DIY Weekend Bookkeeping

Let me be straight with you: that “I’ll do it this weekend” habit is costing you way more than you think.

Time you’ll never get back: Most small business owners spend 10-15 hours per month on bookkeeping when they try to do it themselves. That’s almost two full workdays. And let’s be honest, it usually takes even longer because you’re learning as you go, fixing mistakes, and trying to remember what that random $47.23 charge from three weeks ago was for.

Mental energy: Even when you’re not doing your books, you’re thinking about them. That nagging guilt follows you around all weekend. It’s there when you’re at your kid’s basketball game. It’s there when you’re trying to relax with friends. It steals your peace of mind.

Actual money: Mistakes in DIY bookkeeping can cost you. Missed deductions. Duplicate entries. Accounts that don’t reconcile. And then when tax time rolls around, your CPA has to spend extra time (that you’re paying for) cleaning up the mess before they can even start your return.

Opportunity cost: Every hour you spend wrestling with spreadsheets is an hour you’re not spending on the parts of your business that actually make money. You didn’t start your business to become a bookkeeper, you started it because you’re great at what you do.

Why We Keep Telling Ourselves This Lie

I think we tell ourselves we’ll “do it this weekend” for a few reasons:

It feels like control. When you’re a small business owner, you’re used to wearing all the hats. Letting go of any task can feel scary, like you’re losing your grip on the business.

It seems like it should be simple. I mean, it’s just numbers, right? How hard can it be? (Spoiler: harder than it looks when you’re trying to track inventory, reconcile accounts, and figure out proper categorization.)

Outsourcing feels expensive. You think, “I can’t afford a bookkeeper.” But here’s the thing, you can’t afford not to have one. Not when you factor in all those costs I just mentioned.

Here’s What Changes When You Stop Lying to Yourself

When you work with us at AKOR Services, here’s what happens to those weekends:

You get 10+ hours back every single month. That’s real time. Time you can spend with your family. Time you can spend growing your business. Time you can spend doing literally anything other than staring at spreadsheets.

Sunday morning becomes Sunday morning again. No guilt. No stress. No wondering if you’re categorizing things correctly or if your accounts are going to reconcile.

Your CPA will actually thank you. We handle all the detail work throughout the year, so when tax time comes, your CPA gets clean, organized books. They can focus on strategy and tax planning instead of fixing errors. You save money on their fees, and you get better advice.

You can actually make informed business decisions. When your books are up to date, actually, genuinely up to date, you know where you stand financially. You can see what’s working and what’s not. You can plan for growth instead of just reacting to whatever’s in your bank account.

How We Make This Work (Without Making It Complicated)

I know you might be thinking, “Okay, but isn’t hiring a bookkeeper going to be a whole thing? More work upfront? Another person to manage?”

Let me walk you through how simple we make this:

We start with a conversation. Just a phone call. You tell me about your business, what’s been keeping you up at night, and what you actually need. No pressure, no sales pitch: just two people talking about your business.

We customize our approach to your actual needs. Not every business needs the same level of service. Some of our clients need weekly attention. Others are fine with monthly. We tailor everything based on what makes sense for your situation and your budget.

We handle the boring stuff. Data entry. Reconciliation. Categorization. Making sure everything lines up. That’s our job, and honestly? We’re good at it because we do it all day, every day.

We work seamlessly with your CPA. We’re not trying to replace your tax professional: we’re here to make their life easier (and yours). When tax season comes, we provide them with clean, organized books so they can do what they do best.

You stay in control. You can log in and see your numbers anytime you want. You get regular updates. And if you have questions, I’m a phone call or email away.

What Real Freedom Looks Like

One of my favorite things about this work is hearing from clients a few months in. They tell me things like:

“I took my kids to the park on Sunday and didn’t think about work once.”

“I actually went hiking last weekend. When was the last time I did that?”

“My CPA said our year-end was the smoothest it’s ever been.”

That’s what we’re really selling here: not just bookkeeping services, but actual freedom. The freedom to run your business without sacrificing your weekends. The freedom to trust that someone’s got this handled. The freedom to stop feeling guilty every Sunday afternoon.

Let’s Get Real About Next Steps

Here’s what I want you to know: I understand if you’re hesitant. Handing over your financial information to someone feels vulnerable. You might be worried about the cost, about giving up control, about whether you can trust someone with something this important.

Those concerns are completely valid, and I take them seriously.

When you work with me, your privacy and security are my top priority. We never share your information without your approval. Everything is clearly spelled out in our engagement letter: no surprises, no hidden fees, just straightforward service.

And here’s the other thing: this isn’t a lifetime commitment. We work together for as long as it makes sense for you. If you want to try it for a few months and see how it goes, that’s completely fine.

Stop Putting It Off

It’s Monday, February 3rd. You’ve probably already started telling yourself you’ll catch up on bookkeeping this weekend.

What if this is the last weekend you have to break that promise?

What if next Sunday, instead of sitting at your kitchen table surrounded by receipts, you’re doing whatever you actually want to be doing?

Give me a call at (360) 334-3373 or shoot me an email at info@akorservices.com. We’ll have a quick conversation about what you need, and we can take it from there. No pressure, no obligation: just a conversation about how we might be able to help.

You can also visit us at akorservices.com/thebooks to learn more about how we work.

Your weekends are waiting. Let’s get them back.