Wait, I Need to Track That? 3 Things Small Biz Owners Often Forget (But We Don't)

Look, I get it. You’re running a business, putting out fires, juggling a hundred things at once. The last thing on your mind is whether you remembered to document every little financial detail. But here’s the thing: those “little details” have a funny way of becoming big problems when tax season rolls around, or worse, when you’re trying to figure out if your business is actually profitable.

I’ve worked with enough small business owners to know that certain things just slip through the cracks. Not because you’re careless, but because you’re busy. And that’s exactly why we’re here.

Let me walk you through three things that almost every small business owner forgets to track properly, and how we make sure they never fall through the cracks when you work with us.

Thing #1: 1099 Contractor Information (Yes, It Needs Tracking All Year Long)

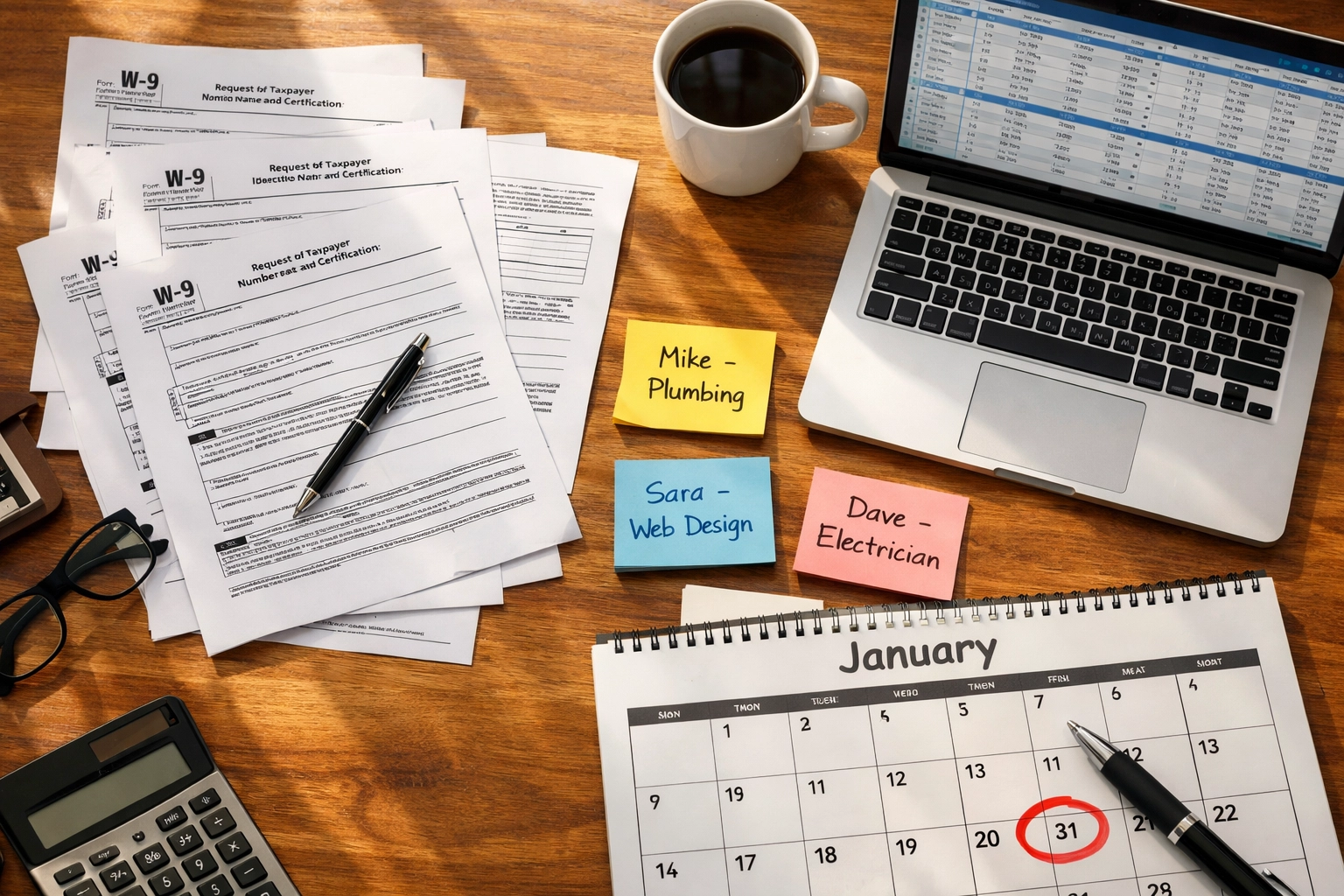

Here’s a scenario I see play out every January: A business owner suddenly realizes they need to send out 1099s to contractors, and they’re scrambling to find names, addresses, Tax ID numbers, and payment totals. Panic sets in. Emails fly. “Hey, what was your address again?” Sound familiar?

The problem is, 1099 information isn’t just a January thing, it needs to be collected and tracked throughout the entire year.

When you hire a contractor, you should be getting their W-9 form immediately. Not later. Not “when you get around to it.” Right away. That form has everything you need: their legal business name, their Tax ID or Social Security Number, and their current address.

But collecting the W-9 is only half the battle. You also need to track every payment you make to that contractor throughout the year. If you pay someone $600 or more during the year, the IRS requires you to send them a 1099-NEC by January 31st of the following year.

Here’s what we do differently:

- We set up your system correctly from day one. Whether you’re using QuickBooks Online or Xero (we’re experts in both), we make sure contractor information is entered properly and flagged appropriately.

- We remind you to collect W-9s when you bring on new contractors, so you’re never chasing paperwork in January.

- We track all contractor payments in real-time, categorizing them correctly so we know exactly who needs a 1099 at year-end.

- We prepare your 1099s (or provide you with the accurate reports you need to file them yourself, your choice).

The peace of mind alone is worth it. No more panic, no more guesswork, no more late-night spreadsheet sessions trying to remember if you paid that graphic designer $580 or $620.

Thing #2: Small Receipt Transactions (The $8 Ones Add Up Fast)

You know those small purchases? The $8 office supply run. The $15 parking fee. The $22 lunch meeting with a potential client. They feel insignificant in the moment, so you don’t bother keeping the receipt. But by the end of the year, those “insignificant” purchases can add up to thousands of dollars in unclaimed deductions.

I’ve had clients who’ve missed out on $3,000+ in legitimate business deductions simply because they didn’t track the small stuff. That’s real money left on the table.

Here’s the reality: the IRS doesn’t care if it’s an $8 expense or an $800 expense, if you get audited, you need proof. And your bank statement showing “Staples – $8.47” isn’t enough. They want to see an actual receipt showing what you bought and that it was for business purposes.

But I also know that expecting you to photograph and categorize every single receipt is unrealistic. That’s where we come in.

We work with you to create a system that actually works for your life:

- Receipt apps integration: We can help you set up mobile apps that let you snap a photo of a receipt the moment you get it, and it syncs directly with your accounting system.

- We reconcile everything: Every transaction gets reviewed and categorized properly, so nothing gets missed or miscategorized.

- We ask the clarifying questions: If something looks off or unclear, we reach out before assuming. That $47 charge at Home Depot, was that for office renovations or personal? We make sure it’s coded correctly.

And here’s the thing: we tailor this to what you actually need. If you’re great at keeping receipts but terrible at entering them, we handle the data entry. If you prefer to stay hands-off entirely, we can manage the whole process. Everyone’s different, and we adjust our approach based on how you work best.

Thing #3: Job Costing and Inventory Details (The Hidden Profit-Killers)

This is the one that surprises people the most. You might think you’re making money on a project or product, but without proper job costing or inventory tracking, you’re really just guessing.

Let me give you an example. Say you’re a contractor who just completed a kitchen remodel. You charged the client $25,000. Sounds great, right? But did you actually track:

- All the materials you purchased for that specific job?

- The subcontractor fees that were tied to that project?

- The labor hours you and your team spent on it?

- The permits and inspection fees?

If you didn’t track those details at the job level, you might think you made a nice profit, when in reality, after all expenses, you barely broke even (or worse, lost money).

Job costing means tracking income and expenses for each specific project or job, so you know exactly what each one costs you and what it earns. It’s essential if you’re in construction, creative services, consulting, or any business where you bill by the project.

Inventory tracking is equally critical if you sell physical products. You need to know:

- What you have on hand

- What it cost you to acquire or produce

- When you need to reorder

- What your actual profit margin is after accounting for Cost of Goods Sold (COGS)

Without this tracking, you’re flying blind. You might be selling products at a loss without even realizing it.

Here’s how we help:

- We set up job costing in QuickBooks Online or Xero so every expense and payment gets tied to the right project.

- We configure inventory tracking that updates in real-time as you buy and sell products.

- We run reports that show you the real numbers: Which jobs were actually profitable? Which products have the best margins? Where are you losing money?

- We help you make better business decisions based on accurate data, not gut feelings.

Again, this is all tailored to your specific needs. Not every business needs complex job costing or inventory management. But if you do need it, we make sure it’s done right from the start.

We’re Here to Handle the Details You Don’t Have Time For

Listen, I know bookkeeping isn’t why you started your business. You started your business because you’re good at what you do, whether that’s building things, creating things, consulting, or providing a service. The financial tracking part? That’s what we’re good at.

We don’t believe in one-size-fits-all solutions. When you work with us, we sit down and figure out what you specifically need. Maybe you just need someone to handle monthly reconciliations and make sure nothing falls through the cracks. Maybe you need full-service bookkeeping with job costing, payroll, and financial reporting. Maybe you’re somewhere in between.

We work with you to create a system that fits your business, your budget, and your comfort level. And we’re experts in both QuickBooks Online and Xero, so we can work within whatever system you prefer (or help you choose the right one if you’re just getting started).

Your privacy is our priority, we never share your information without your approval. And we’re always there for you if questions come up or you need guidance on a financial decision.

Let’s Make Sure Nothing Gets Forgotten

If you’re tired of the “Oh no, did I track that?” panic, let’s talk. We’ll start with a simple conversation about what you need and how we can help.

Give us a call at (360) 334-3373 or email me at info@akorservices.com. You can also learn more about our services at akorservices.com/thebooks.

We’ll take it from there: no pressure, no complicated contracts, just a straightforward conversation about how we can help you stop forgetting the important stuff.

Because honestly? You’ve got enough on your plate. Let us handle the details that keep your books clean, your taxes accurate, and your business running smoothly.