Mid-January Stress: Are You in 'The Scramble' for W-9s and 1099s?

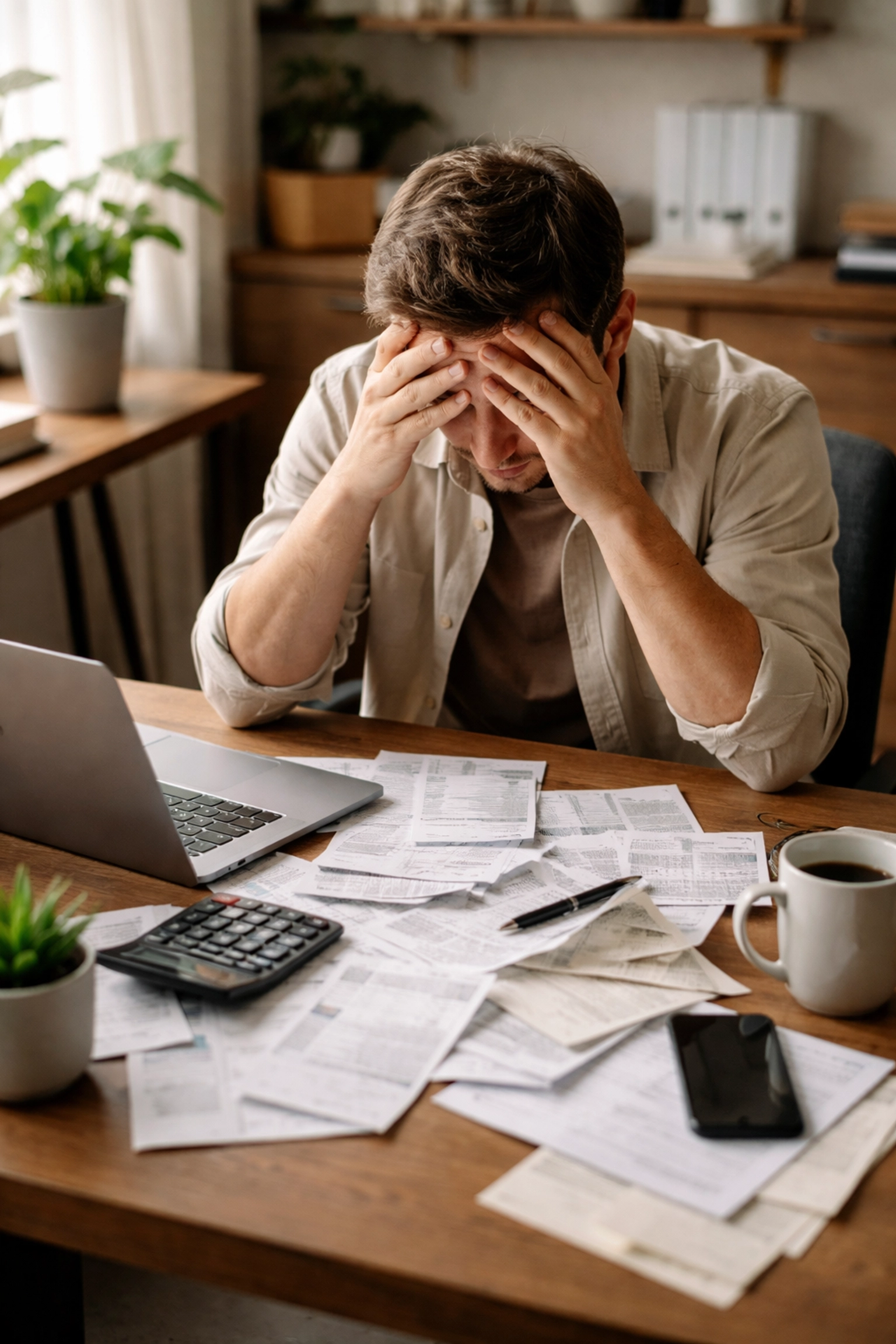

If you’re reading this right now, there’s a good chance you’ve got a pit in your stomach. Maybe you just realized you don’t have W-9s on file for half your contractors. Maybe you’re staring at a pile of receipts and bank statements wondering where to even begin. Or maybe you just Googled “1099 deadline 2026” and felt your heart skip a beat.

Take a breath. You’re not alone, and you’re definitely not the first business owner to find yourself in what I affectionately call The Scramble.

What Exactly Is “The Scramble”?

The Scramble is that frantic two-week period in mid-January when business owners suddenly remember: Oh no, I have to send out 1099s. And wait, do I even have everyone’s W-9 information?

It happens every year. The holidays wind down, you get back into the swing of things, and then BAM, tax compliance season smacks you right in the face.

Here’s the thing: I get it. Running a business is hard enough without having to keep track of IRS deadlines, form requirements, and contractor paperwork. You’ve got customers to serve, employees to manage, and a million other things on your plate.

But those 1099s? They’re not going away. And the deadlines are closer than you think.

The 2026 Deadlines You Need to Know

Let me give you some good news first: because January 31st falls on a weekend this year, the deadlines have shifted slightly. But “slightly” doesn’t mean you have tons of extra time.

Here’s the breakdown:

- 1099-NEC forms (for non-employee compensation): Must be delivered to recipients and filed with the IRS by February 2, 2026

- 1099-MISC forms: Recipients must receive their copies by February 2, 2026. IRS filing is due March 2 for paper or March 31 for electronic filing

So yes, you have until February 2nd. But if you’re missing W-9s, haven’t verified payment amounts, or don’t even know who needs a 1099… that deadline is going to sneak up on you fast.

Why W-9s Matter Right Now

Here’s something a lot of business owners don’t realize until it’s too late: you can’t prepare a 1099 without a W-9.

The W-9 is the form that gives you the contractor’s name, address, and Taxpayer Identification Number (TIN). Without that information, you’re stuck.

Now, technically, you should be collecting W-9s before you pay a contractor for the first time. But let’s be honest, when you’re busy running your business, that paperwork sometimes falls through the cracks.

If you’re sitting there right now thinking, I definitely don’t have W-9s for everyone I paid last year, you’re not alone. This is one of the most common issues I see with new clients.

The good news? It’s not too late to collect them. But you need to act fast.

The Real Cost of Procrastinating

I know, I know, taxes aren’t exactly exciting. It’s tempting to push this stuff to the back burner and deal with it “later.”

But here’s what happens when “later” becomes “too late”:

IRS penalties for late or incorrect 1099s escalate quickly:

- $60 per form if filed up to 30 days late

- $120 per form if filed 31 days late through August 1

- $310 per form if filed after August 1

- $630 per form for intentional disregard

Let’s say you have 10 contractors and you miss the deadline by a couple of months. That’s potentially $1,200 or more in penalties, money that could have stayed in your pocket.

And beyond the financial hit, there’s the stress. The phone calls. The scrambling to find information. The nagging feeling that you’re behind on something important.

Trust me, it’s not worth it.

Your Mid-January Action Checklist

Okay, let’s get practical. Here’s what you need to do right now to avoid The Scramble turning into a full-blown crisis:

1. Review your records

Go through your books and identify everyone you paid $600 or more in 2025 who wasn’t a W-2 employee. Contractors, freelancers, consultants, service providers, they all count.

2. Collect missing W-9s

Reach out to anyone you don’t have a W-9 on file for. Send a friendly email or text asking them to fill out the form ASAP. Most people will respond quickly if you explain why it’s urgent.

3. Verify payment amounts

Double-check your records to make sure you have accurate totals for each contractor. This is where clean, organized books really pay off.

4. Organize your documentation

Get everything in one place, W-9s, payment records, contact information. The more organized you are now, the easier filing will be.

5. File on time

Whether you’re filing yourself or working with a professional, make sure those forms go out by February 2nd.

You Don’t Have to Do This Alone

Here’s where I come in.

At AKOR Services Bookkeeping, we help small business owners like you handle the legwork so you can focus on what you do best, running your business.

We can help you with:

- Tracking down and collecting W-9s from contractors

- Reviewing your records to identify who needs a 1099

- Verifying payment amounts and ensuring accuracy

- Organizing your documentation for easy filing

- Coordinating with your CPA or tax professional to make sure everything lines up

I want to be clear about something: we’re not CPAs, and we don’t prepare tax returns. But we work hand-in-hand with your tax professional to make sure your books are clean, your records are accurate, and you have everything you need when tax time rolls around.

Think of us as the bridge between the day-to-day chaos of running your business and the organized, stress-free tax season you deserve.

Why Year-Round Bookkeeping Makes a Difference

Here’s a little secret: the business owners who don’t experience The Scramble every January? They’re the ones who keep their books organized all year long.

When your books are up to date, you already know:

- Who you paid

- How much you paid them

- Whether you have their W-9 on file

- What forms need to go out

No scrambling. No panic. No last-minute phone calls begging contractors to send their information.

Instead of treating January like a fire drill, it becomes just another month. Maybe even a boring one (in the best way possible).

That’s the peace of mind that comes with having a bookkeeping partner in your corner.

Let’s Talk (No Pressure, I Promise)

If you’re feeling overwhelmed right now, I want you to know: it’s okay to ask for help.

We offer a free initial consultation where we can chat about your situation, answer your questions, and figure out the best path forward. No pressure, no hard sell, just a conversation to see if we’re a good fit.

You can reach us at:

- Phone: (360) 334-3373

- Email: Allen@akorservices.com

- Website: akorservices.com/thebooks

Whether you need help getting through this year’s 1099 season or you’re ready to set up a system so you never have to scramble again, we’re here for you.

The Bottom Line

Mid-January doesn’t have to be stressful. Yes, the deadlines are real. Yes, the penalties are steep. But with a little planning and the right support, you can get through this season with your sanity intact.

So take a deep breath. Make a list. And if you need a hand, give us a call.

We’ve got your back.

Tags: Bookkeeping, AKOR Services Bookkeeping, 1099, Taxes, W-9