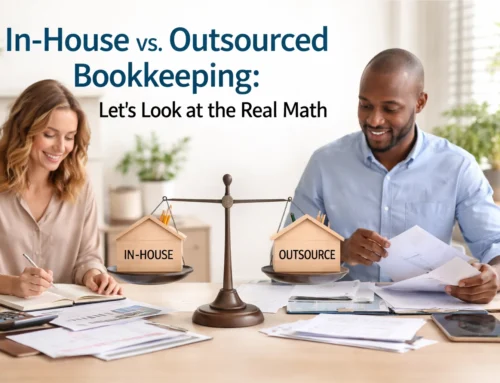

How to Integrate Your Monthly Bookkeeper With Your CPA (Easy Guide for Small Businesses)

I know you might be feeling overwhelmed about coordinating multiple financial professionals. You’re probably wondering if it’s worth the expense to have both a bookkeeper and a CPA (or Accountant), or if they’ll just create more confusion by working separately.

Let me put your mind at ease: when your monthly bookkeeper and CPA work together properly, it’s like having a perfectly coordinated financial team that saves you time, money, and stress.

Why Integration Actually Makes Your Life Easier

When you work with me at AKOR Services, I make sure your bookkeeping seamlessly connects with your CPA’s work. Think of it this way: I handle the day-to-day financial maintenance while your CPA focuses on the big-picture strategy and tax planning.

Here’s what I take care of monthly:

- Recording all your transactions and keeping everything current

- Reconciling your bank accounts and credit cards

- Managing accounts payable and receivable

- Processing payroll and related taxes

- Preparing clean, accurate financial statements

Your CPA uses these organized records to provide strategic advice, tax planning, and ensure compliance. When we work together, your CPA spends time on high-value advisory work instead of catching up on messy books.

Setting Up Your Financial Foundation

I know you’re probably concerned about the initial setup process and whether it will disrupt your business operations. The truth is, getting your books organized upfront is the key to everything working smoothly afterward.

When we start working together, I complete a comprehensive setup that typically takes 2-4 weeks depending on your business history. During this time, I:

- Enter all your historical financial information into our bookkeeping system

- Set up your chart of accounts with proper categories

- Connect your bank accounts and credit cards for automated data entry

- Organize all necessary financial records

This one-time investment creates the foundation your CPA needs to provide valuable advice throughout the year. We use cloud-based software like QuickBooks Online or Xero Accounting software, which means your CPA can access your current financial data anytime (with your permission) without waiting for file transfers.

How We Coordinate Monthly Tasks

You don’t need to worry about managing the communication between your bookkeeper and CPA: I handle that coordination for you. Each month, I complete all the essential bookkeeping tasks by a specific date we agree upon.

My monthly process includes:

- Account reconciliation for all business accounts

- Recording and categorizing all revenue and expenses

- Processing payroll and tax obligations

- Performing month-end close procedures

- Preparing financial statements (P&L, Balance Sheet, Cash Flow)

After completing your monthly books, I provide your CPA with clean, organized financial statements. I also flag any potential tax issues or questions that might benefit from their expertise.

Establishing Clear Communication

I understand you might be worried about miscommunication or gaps between your financial professionals. That’s why I establish clear protocols with your CPA from the beginning.

Here’s how we stay connected:

- I share questions about expense categorization or tax implications directly with your CPA

- Your CPA communicates any accounting changes or strategies they want implemented

- We hold quarterly check-ins to review financial performance and plan ahead

- Both professionals always keep you informed of any important discussions

This structured communication prevents surprises and ensures everyone understands your business’s current financial state and future direction.

Technology Makes Integration Seamless

You probably have concerns about data security and access. When you work with me, I set up secure, controlled access that protects your information while enabling collaboration.

I grant your CPA appropriate read-only access to your bookkeeping platform (with your permission), which means they can review your books and prepare for tax planning without editing your daily entries. This maintains security while providing transparency.

Our automated data entry system connects your business bank accounts to the bookkeeping software, so transactions flow automatically. This means your CPA always has access to current transaction data without delays.

Tax Season Becomes Stress-Free

I know tax season probably causes you anxiety, especially if you’ve dealt with disorganized records in the past. When your books are consistently maintained throughout the year, tax season becomes much smoother.

By tax time, I have your books completely current and reconciled. Your CPA can immediately begin tax preparation using accurate, organized records instead of spending hours on catch-up work. This coordination saves both professional fees and reduces your stress.

If your business has fallen behind on bookkeeping, I offer catch-up services that typically take 2-4 weeks to get 2+ years of records current. It’s a one-time investment that positions you for smooth coordination going forward.

How AKOR Services Makes This Partnership Work

You might be wondering how to find professionals who actually work well together. When you choose AKOR Services for your monthly bookkeeping, I already have experience collaborating with many local CPAs and tax professionals.

We offer several coordination benefits:

- Established relationships with trusted CPA firms in our area

- Proven systems for sharing financial data securely

- Experience with different tax planning strategies

- Flexible service levels based on your specific needs

We tailor our services based on your business requirements. Not every small business needs the same level of CPA involvement: some clients need quarterly strategic planning while others only require annual tax preparation.

Determining What’s Right for Your Business

You don’t need to figure this out alone. During our free initial consultation, we discuss your current financial situation and help you understand exactly what bookkeeper and CPA coordination would look like for your business.

We can help you determine:

- Whether your current CPA is a good fit for ongoing collaboration

- What level of monthly bookkeeping services you actually need

- How to structure the communication between all parties

- Timeline and costs for getting everything coordinated

Many of our clients discover they were paying for overlapping services or missing opportunities for tax savings because their bookkeeper and CPA weren’t working together effectively.

Your Next Steps Are Simple

I understand you might still feel apprehensive about making changes to your financial management system. Let’s start with a conversation about your specific situation and concerns.

Here’s what happens next:

- We schedule a free initial consultation to review your current setup

- I explain exactly how integration would work for your business

- We discuss timeline, costs, and what to expect

- You decide if moving forward makes sense for your situation

There’s no pressure and no long-term commitments required. We work with you for as long as you want to continue, and everything will be clearly spelled out in our engagement letter.

Your privacy is our priority: we never share your information without your approval, and all communications between your financial professionals remain confidential.

Ready to Simplify Your Financial Management?

You deserve to have financial professionals who work together seamlessly on your behalf. When your bookkeeping and tax planning are properly coordinated, you gain clarity about your business performance and confidence in your financial decisions.

Let’s begin with a phone call to discuss how AKOR Services can integrate with your existing CPA or help you find the right tax professional for your business needs.

Contact us today to schedule your free initial consultation. We’re here Monday through Friday, and we’re always available if you need support along the way.

Tags: Bookkeeping, AKOR Services Bookkeeping, monthly bookkeeper, affordable bookkeeping services